Extra monetary advisors are stepping into insurance coverage and ladies are outpacing males in enterprise development, each due to a broader scope of providers, in keeping with the most recent version of the skilled advisor examine carried out by LIMRA and EY.

These are two high-level findings within the examine up to date from 2018, mentioned Laura Murach, LIMRA and LOMA analysis director, who’s moderating a presentation Sunday with Avril Castagnetta, EY advertising transformation chief, and Bryan Hodgens, LIMRA and LOMA head of distribution analysis and annuity analysis. The advisors had a minimum of three years of expertise, with a median of 21 years within the enterprise and a median of 51 years previous.

“Our key theme, after we did this survey in 2018, was we actually began seeing the blurring of distribution channels,” Murach mentioned. “And we’re actually seeing now that it isn’t as blurry anymore. We’re seeing extra high performers throughout all channels that actually have extra of a holistic, planning-centric mannequin.”

Though the survey included a wide selection – insurance coverage producers, dealer/seller representatives, registered funding advisors and financial institution representatives – the blurring of strains was largely monetary advisors into the insurance coverage house.

Murach attributed a part of the shift to COVID wake-up name. “The pandemic gave folks pause they usually needed to guard,” Murach mentioned. “So we’re seeing advisors shifting to these safety merchandise.”

Murach couldn’t present particular numbers from the survey as a result of researchers are nonetheless pulling collectively the ultimate report and presenters on Sunday plan to the touch on high-level findings.

Girls leap forward

However Murach was capable of say that feminine advisors greater than doubled the variety of life insurance coverage insurance policies offered from 2019 and 2021. Girls additionally outpaced males within the variety of annuity contracts. The ratio of girls vs. males was roughly equal in each surveys, she mentioned, with girls being about 10% of the pattern.

“Our outcomes are suggesting that the feminine advisors could take extra of a holistic view of their shopper’s wants as a result of they do provide a broader vary of providers like retirement planning, insurance coverage planning and budgeting,” Murach mentioned. “Simply the breadth of providers helps clarify their rising numbers of coverage life insurance coverage insurance policies and annuity contracts.”

Girls tended to deal with the shopper relationship greater than merchandise. “Feminine advisors appear extra keen to put money into providers that will not repay within the close to time period,” Murach mentioned. “They are not about promote that product. They’re extra, let’s construct a relationship as a result of it’ll be stronger over time.”

Product choice

In relation to life merchandise, notably annuities, advisors mentioned their shoppers are confused in regards to the merchandise and their match into their general portfolio.

“They’re saying if we will make the product less complicated, and actually present the worth that they create to our shoppers, that might assist with development,” Murach mentioned. “For 3 in 10 of the advisors, essentially the most tough facets of the life insurance coverage gross sales course of is for shoppers to know how insurance coverage merchandise slot in with different monetary merchandise.”

Shoppers had issue understanding facets similar to life illustrations and ensures vs. market returns, Murach mentioned. Product is the highest concern with insurance coverage gross sales. However it went hand-in-hand with service and the gross sales expertise.

“If you do not have the product, they don’t seem to be going to come back to you,” she mentioned. “However for those who you probably have the product however not the expertise, you are not going to get repeat enterprise.”

Murach mentioned the gross sales expertise included an environment friendly, constant software course of in addition to the combination of advisor platforms and illustrations.

“What was fascinating was expertise was actually a key differentiator for all times insurance coverage,” Murach mentioned. “However with annuities, you actually need to have the precise product with the precise options, and aggressive prices and costs related to it.”

Turning into social

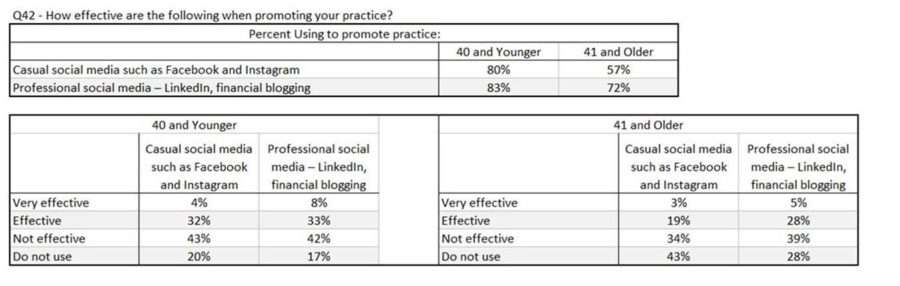

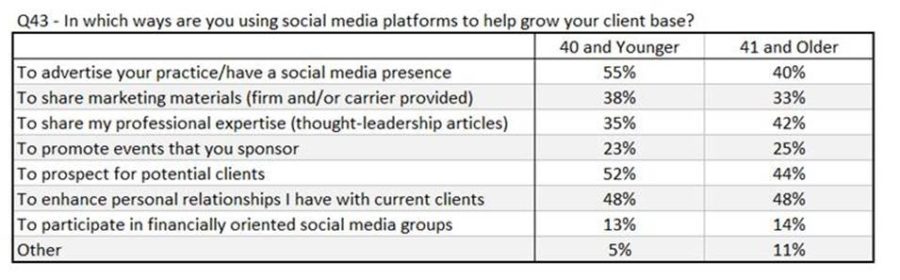

Utilizing social media for prospecting additionally elevated reasonably since 2018, particularly for these below 40.

The use has grown largely by insurance coverage producers in each the impartial and profession channels.

“They’re actually essentially the most bullish on future social media use,” Murach mentioned. “And we expect that comes from recruiting social media expertise. We discovered that advisors notice the necessity to put money into social media expertise they usually usually have excessive larger development practices. They usually actually count on to see a big acceleration within the variety of shoppers that they purchase by means of social media within the close to future.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has greater than 25 years of expertise as a reporter and editor for newspapers and magazines. He was additionally vp of communications for an insurance coverage brokers’ affiliation. Steve may be reached at [email protected]

© Complete contents copyright 2022 by InsuranceNewsNet. All rights reserved. No a part of this text could also be reprinted with out the expressed written consent from InsuranceNewsNet.