Hurricane Ian’s widespread harm is one other catastrophe for Florida’s already shaky insurance coverage business. Although residence insurance coverage charges in Florida are almost triple the nationwide common, insurers have been dropping cash. Six have failed since January 2022. Now, insured losses from Ian are estimated to exceed US$40 billion

Hurricane danger may look like the apparent drawback, however there’s a extra insidious driver on this monetary practice wreck.

Finance professor Shahid Hamid, who directs the Laboratory for Insurance coverage at Florida Worldwide College, defined how Florida’s insurance coverage market acquired this dangerous – and the way the state’s insurer of final resort, Residents Property Insurance coverage, now carrying greater than 1 million insurance policies, can climate the storm.

What’s making it so exhausting for Florida insurers to outlive?

Florida’s insurance coverage charges have nearly doubled prior to now 5 years, but insurance coverage firms are nonetheless dropping cash for 3 primary causes.

One is the rising hurricane danger. Hurricanes Matthew (2016), Irma (2017) and Michael (2018) had been all damaging. However plenty of Florida’s hurricane harm is from water, which is roofed by the Nationwide Flood Insurance coverage Program, relatively than by personal property insurance coverage.

One more reason is that reinsurance pricing goes up – that’s insurance coverage for insurance coverage firms to assist when claims spike.

However the greatest single motive is the “project of advantages” drawback, involving contractors after a storm. It’s partly fraud and partly profiting from unfastened regulation and court docket selections which have affected insurance coverage firms.

It typically seems like this: Contractors will knock on doorways and say they’ll get the house owner a brand new roof. The price of a brand new roof is perhaps $20,000-$30,000. So, the contractor inspects the roof. Typically, there isn’t actually that a lot harm. The contractor guarantees to handle all the pieces if the house owner assigns over their insurance coverage profit. The contractors can then declare no matter they need from the insurance coverage firm without having the house owner’s consent.

If the insurance coverage firm determines the harm wasn’t truly lined, the contractor sues.

So insurance coverage firms are caught both preventing the lawsuit or settling. Both manner, it’s expensive.

Different lawsuits might contain owners who don’t have flood insurance coverage. Solely about 14% of Florida owners pay for flood insurance coverage, which is usually out there by way of the federal Nationwide Flood Insurance coverage Program. Some with out flood insurance coverage will file harm claims with their property insurance coverage firm, arguing that wind precipitated the issue.

How widespread of an issue are these lawsuits?

Total, the numbers are fairly putting.

About 9% of house owner property claims nationwide are filed in Florida, but 79% of lawsuits associated to property claims are filed there.

The authorized price in 2019 was over $3 billion for insurance coverage firms simply preventing these lawsuits, and that’s all going to be handed on to owners in larger prices.

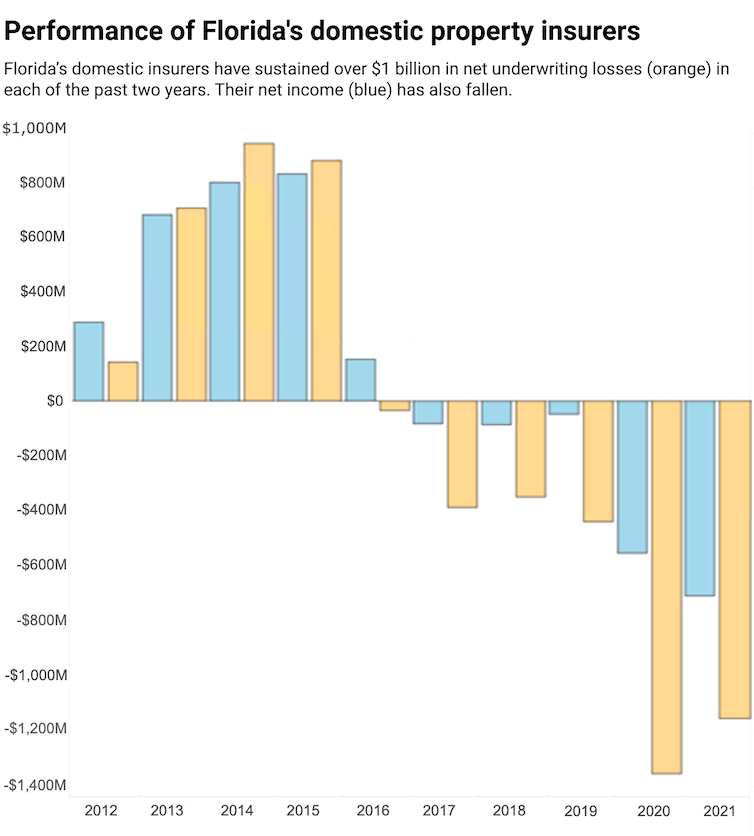

Insurance coverage firms had a greater than $1 billion underwriting loss in 2020 and once more in 2021. Even with premiums going up a lot, they’re nonetheless dropping cash in Florida due to this. And that’s a part of the rationale so many firms are deciding to go away.

Task of advantages is probably going extra prevalent in Florida than most different states as a result of there’s extra alternative from all of the roof harm from hurricanes. The state’s regulation can also be comparatively weak. This may increasingly ultimately be mounted by the legislature, however that takes time and teams are lobbying in opposition to change. It took a very long time to cross a legislation saying the legal professional price must be capped.

How dangerous is the scenario for insurers?

We’ve seen a couple of dozen firms be declared bancrupt or depart since early 2020. A minimum of six dropped out this yr alone.

Thirty extra are on the Florida Workplace of Insurance coverage Regulation’s watch checklist. About 17 of these are more likely to be or have been downgraded from A score, that means they’re now not thought-about to be in good monetary well being.

Based mostly on a Florida Workplace of Insurance coverage Regulation chart

The scores downgrades have penalties for the true property market. To get a mortgage from the federal mortgage lenders Freddie Mac and Fannie Mae, you must have insurance coverage. But when an insurance coverage firm is downgraded to under A, Freddie Mac and Fannie Mae gained’t settle for it. Florida established a $2 billion reinsurance fund in Could 2022 that may assist smaller insurance coverage firms in conditions like this. In the event that they get downgraded, the reinsurance can act like co-signing the mortgage so the mortgage lenders will settle for it.

However it’s a really fragile market.

Ian could possibly be one of many costliest hurricanes in Florida historical past. I’ve seen estimates of $40 billion to $60 billion in losses. I wouldn’t be shocked if a few of these firms on the watch checklist depart after this storm. That can put extra strain on Residents Property Insurance coverage, the state’s insurer of final resort.

Some headlines recommend that Florida’s insurer of final resort can also be in hassle. Is it actually in danger, and what would that imply for residents?

Residents shouldn’t be going through collapse, per se. The issue with Residents is that its coverage numbers usually swell after a disaster as a result of as different insurers exit of enterprise, their insurance policies shift to Residents. It sells off these insurance policies to smaller firms, then one other disaster comes alongside and its coverage numbers rise once more.

Three years in the past, Residents had half one million insurance policies. Now, it has twice that. All these insurance coverage firms that left within the final two years, their insurance policies have been migrated to Residents.

Ian will probably be expensive, however Residents is flush with money proper now as a result of it had plenty of premium will increase and constructed up its reserves.

Ricardo Arduengo / AFP through Getty Pictures

Residents additionally has plenty of backstops.

It has the Florida Hurricane Disaster Fund, established within the Nineteen Nineties after Hurricane Andrew. It’s like reinsurance, nevertheless it’s tax-exempt so it will probably construct reserves sooner. As soon as a set off is reached, Residents can go to the disaster fund and get reimbursed.

Extra importantly, if Residents runs out of cash, it has the authority to impose a surcharge on everybody’s insurance policies – not simply its personal insurance policies, however insurance coverage insurance policies throughout Florida. It may well additionally impose surcharges on another forms of insurance coverage, reminiscent of life insurance coverage and auto insurance coverage. After Hurricane Wilma in 2005, Residents imposed a 1% surcharge on all house owner insurance policies.

These surcharges can bail Residents out to a point. But when payouts are within the tens of billions of {dollars} in losses, it can in all probability additionally get a bailout from the state.

So, I’m not as fearful for Residents. Householders will need assistance, although, particularly in the event that they’re uninsured. I anticipate Congress will approve some particular funding, because it did prior to now for hurricanes like Katrina and Sandy, to offer monetary assist for residents and communities.