Adam Hyers has been serving the Medicare marketplace for so lengthy that now he’s starting to work with the youngsters of his authentic purchasers.

And this new era of older purchasers doesn’t need to work with him in the identical method as their mother and father did.

Hyers is proprietor of Hyers and Associates in Columbus, Ohio, a agency he based 20 years in the past. However he began serving the senior market a number of years previous to that. Throughout his 25 years or so in enterprise, he has seen some stereotypes about working with seniors fall by the wayside.

For instance, overlook concerning the standard knowledge that older customers don’t need to do enterprise on-line and solely need to meet with their advisors within the workplace or “throughout the kitchen desk.”

“Many older purchasers are on Fb as a result of that’s the place they’re going to see what the children and the grandkids are as much as and see the photographs of individuals of their household having holidays and doing different issues. So there’s completely no query that older purchasers are extra comfy on-line than they have been a decade in the past,” he mentioned. “After which a lot of them are in several types of on-line teams the place they’re gathering info and studying about Medicare merchandise.”

Older purchasers could choose an advisor primarily based on a referral from a good friend or relative, however Hyers mentioned he has discovered a lot of his purchasers additionally go surfing to analysis an advisor earlier than they comply with do enterprise.

“They are going to examine with the Higher Enterprise Bureau or Google rankings to see what sort of evaluations an advisor has,” he mentioned. “That’s why it has been so essential for us to construct belief on-line by having good evaluations, sturdy rankings. After you’ve earned somebody’s belief, you may ask them to put in writing a evaluate someplace, and you’ll publish these evaluations in your web site.”

Hyers depends on web advertising to achieve these online-savvy seniors.

“I attribute a few of our success to writing articles, posting content material or creating promoting that contact on a number of the issues that individuals on this age group are searching for,” he mentioned. “It may be dental and imaginative and prescient protection to go together with a Medicare Complement or Medicare Benefit plan, or maybe it’s a few increased annuity price. Possibly it’s about one thing aimed toward seniors, akin to Silver Sneakers. I take heed to and collect info from the conversations I’ve with individuals and attempt to discover the themes that come up most frequently, after which contact on these themes once we add content material on-line.”

The rise in automation relating to Medicare plans and associated merchandise additionally has been a giant change Hyers mentioned he has seen over time. He believes purchasers see that change as being extra handy for them, whereas the advisor sees elevated on-line instruments as including extra effectivity to their work.

Hyers mentioned he has many out-of-state purchasers who enroll in protection by means of his web site. They will choose a dental or a imaginative and prescient coverage or a prescription drug plan along with enrolling in a Medicare plan.

The problem in holding in-person consumer conferences throughout COVID-19 lockdowns led to many purchasers changing into extra comfy with assembly on-line and performing duties on-line, Hyers mentioned.

“I additionally suppose individuals now notice how a lot time [in-person meetings] take up,” he mentioned. “Seniors might be and are sometimes simply as busy as we’re. They’ve issues to do and locations to go. Once they’re able to enroll, they need to get it performed after which transfer on to their subsequent undertaking.

“And I additionally suppose the times of being the Medicare agent on the highway all week are going away. So we now have to work extra electronically and on-line. This enables us to be extra productive.”

One other massive change Hyers mentioned he has seen out there is the rising variety of selections customers have in choosing Medicare merchandise.

“I don’t need to say that each one these selections are making customers powerful consumers, however I do consider they’re changing into extra knowledgeable consumers,” he mentioned. “They’ve particular wants and particular requests. So that you need to just remember to’ve received an entire quiver stuffed with arrows; in any other case, that enterprise could go some place else.

Dominate your ZIP code

Medicare open enrollment for 2023 begins Oct. 15 and runs by means of Dec. 7. Because the U.S. inhabitants continues to age, the scale of the senior market retains getting larger. The variety of Medicare beneficiaries is projected to develop from round 63 million in 2020 to greater than 93 million in 2060, in response to KFF analysis.

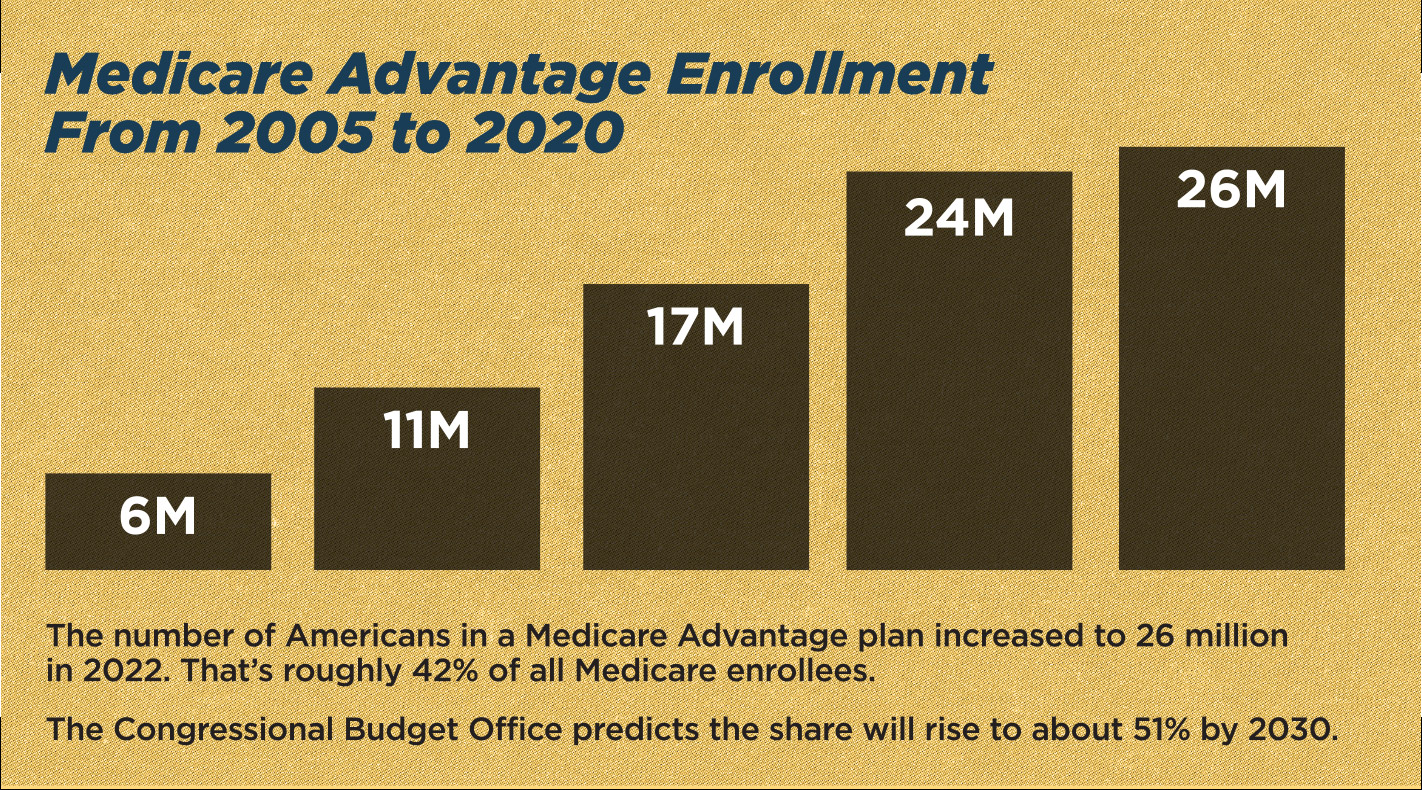

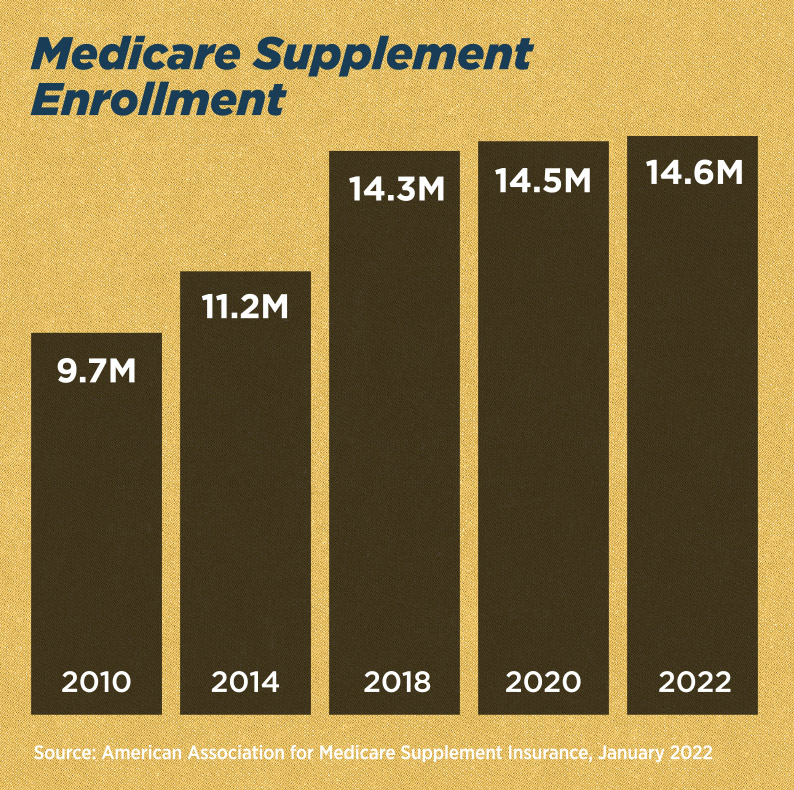

Jesse Slome is director of the American Affiliation for Medicare Complement Insurance coverage and has spent a giant portion of his profession in monitoring traits and statistics for that market section. He has seen enrollment in Medicare Benefit plans rocket from 6 million in 2005 to 26 million in 2022. Medicare Complement enrollment is also on the rise — from 9.7 million enrollees in 2010 to 14.6 million in 2022.

One of many largest challenges Slome mentioned he sees for advisors who need to serve the senior market is the competitors they face from what he calls “mega entrepreneurs,” Medicare Benefit firms that flood the TV airwaves and journal promoting pages with celebrities endorsing their merchandise.

How does a person advisor compete with the likes of Joe Namath or Jimmie “J.J.” Walker? By “dominating their ZIP code,” Slome mentioned.

“It’s by establishing your self because the native go-to individual for Medicare plan info and in the end, options,” he mentioned.

“I consider that the long run for Medicare brokers and brokers is speaking and educating seniors to the truth that Medicare is a nationwide program, however the out there choices are native,” Slome mentioned. “A shopper can name all the decision facilities and all of the toll-free numbers they need, however they need to converse to a neighborhood Medicare specialist.”

Simply as Hyers discovered his purchasers are spending extra time on-line researching their choices, Slome suggested those that need to serve the senior market to develop a robust on-line presence.

“It’s essential for advisors to create a superb LinkedIn profile as a result of prospects will look you up on-line,” he mentioned. “At present, we don’t simply exit to eat at a restaurant; we go surfing and discover which restaurant has essentially the most stars or the perfect rankings and we eat there. So it’s essential that advisors even have good rankings and good feedback on-line as nicely.”

After creating a robust on-line profile, an advisor can take a number of different steps towards dominating their ZIP code, Slome mentioned. A few of these strategies might be as old style as placing a magnetic signal on their automotive promoting their companies. Conducting seminars in public libraries or neighborhood facilities will work for somebody whose market is in a smaller neighborhood.

Slome mentioned some advisors he is aware of will contact employers of their neighborhood and provide what their well being care choices are to come back in yearly to elucidate to employees who’re turning 65 or who’re about to retire.

Advisors received’t get each shopper who needs to enroll in protection, Slome mentioned.

“There’s a sure group of customers who will name a quantity they see marketed, and they’re going to do regardless of the individual on the opposite finish of the cellphone tells them to do,” he mentioned. “However there actually is a section of the inhabitants who will see the promoting and say, ‘I believe I can do higher. I need to discuss to somebody.’”

Educate your self and your purchasers

Sandy Salcido’s recommendation to those that need to reach working with seniors might be summed up in a single phrase: training.

Salcido owns Take Motion Insurance coverage Providers in Rancho Cucamonga, Calif., and has specialised within the senior market since 2010. She was impressed to serve that market section after caring for her mother-in-law, who was on Medicare when she was identified with amyotrophic lateral sclerosis and in the end died from the illness.

“We didn’t know something about Medicare on the time,” she mentioned. “We didn’t know something about ALS. And so we had a hands-on expertise and discovered about that. After she died, I wished to study extra about Medicare as a result of on the time, my mother and father have been 65 years outdated, and I wished to teach myself in order that I might assist them.”

Along with educating themselves about Medicare, Salcido mentioned, advisors additionally ought to educate their purchasers on the choices out there to assist them make the perfect choices.

She additionally has seen older purchasers changing into extra comfy with doing enterprise on-line. “That’s been the most important change I’ve seen up to now 12 years,” she mentioned. “Somebody who was turning 65 years outdated 12 years in the past didn’t have the technical savvy that somebody turning 65 at the moment has. We’re having extra Zoom conferences and speaking extra by textual content than ever earlier than.”

That technical savvy could be a two-edged sword, she added. “Shoppers are bombarded with messages about totally different merchandise, and typically they are often pulled into one thing that’s improper for them.”

Salcido mentioned she will be able to’t defend individuals from being lured by an promoting message, however she will be able to educate them to make an knowledgeable selection.

“I would like my purchasers to be educated,” she mentioned. “I inform them, in case you see one thing fascinating on the market, come discuss to me about it, and we will examine into it and see if it’s the appropriate factor for you.”

Assist purchasers dwell their greatest lives

Serving older purchasers means discussing long-term care and different points along with Medicare.

And it’s about greater than promoting them one thing, mentioned Lori Gubash, nationwide gross sales director for long-term care and Medicare with The Krause Company, an unbiased advertising group primarily based in DePere, Wis.

“Don’t go in telling your consumer what they want, however as an alternative, ask them what they should dwell their greatest life in retirement,” she mentioned.

Asking questions is one technique to decide what a consumer envisions for his or her later years and how one can assist them meet that imaginative and prescient, Gubash mentioned.

“Ask questions akin to, in case you have been to wish care, what would you need that to appear to be? Do you need to keep within the dwelling you reside in now, or do you need to transfer to a different neighborhood? The place do your youngsters dwell, and do you need to dwell near them?”

Gubash mentioned she by no means leads a consumer assembly with a dialogue on insurance policies or merchandise. “I simply hear,” she mentioned. “You must have interaction that individual and never deal with them like a quantity or as simply one other sale.”

The COVID-19 pandemic “made individuals get up and take discover” of the prospect of their very own want for care, Gubash mentioned.

“It scared lots of people out of their perception that the necessity for care isn’t one thing that may occur to them. Individuals are their longevity otherwise, they usually need to mitigate their threat.”

When a shopper begins fascinated by their long-term care threat, Gubash mentioned, the primary individual they flip to is an advisor, and the very first thing they need to know is what they’ll afford.

One of many traits she is seeing in long-term care insurance coverage is that extra carriers are providing protection for short-term care — care that extends for 364 days or much less — and that protection doesn’t require medical underwriting. She is also seeing extra life insurance coverage and annuity merchandise which have an LTC or a crucial sickness profit, and people merchandise are interesting to those that haven’t fairly reached senior citizen standing but.

“Saying you’re too younger to contemplate long-term care just isn’t an possibility anymore,” she mentioned.

Above all, Gubash mentioned, advisors ought to take heed to their purchasers’ issues and questions as an alternative of leaping in with potential options.

“Should you’re on the market utilizing scare techniques or spreadsheeting somebody, your consumer will find yourself with ‘evaluation paralysis,’ and they’re going to delay making a call indefinitely.”