What You Have to Know

- Fitch says a weak U.S. economic system would squeeze life and annuity gross sales in North America.

- Rising authorities bond charges could be nice for all times insurer capital ranges.

- Excessive capital ranges may assist North American life insurers purchase life insurers elsewhere on the earth.

In a traditional unhealthy economic system, North American life insurance coverage and annuity issuers ought to do effectively.

Analysts at Fitch Rankings give that evaluation in a take a look at how they suppose the world’s insurers may do in a world the place authorities banks world wide are pushing up rates of interest in an effort to carry down costs.

Analysts at Fitch and its rivals assist lenders and insurance coverage patrons determine how robust insurers are. The concepts that go into their scores have an effect on how a lot insurers must pay after they challenge bonds, and the way a lot they will cost for the life insurance coverage insurance policies and annuities they promote.

An financial droop may damage North American life insurers’ gross sales, however the results on revenue margins and reserves would probably be impartial, and rising charges could be nice for these life insurers’ funding yields, the analysts predict.

What It Means

Among the similar ranking analysts who’ve stated for years that North American life insurers may deal with the claims from a serious pandemic — and, when COVID-19 hit, turned out to be proper — now say that these life insurers can deal with a traditional unhealthy economic system.

The Unhealthy Economic system Situation

For North America, the analysts assume {that a} regular unhealthy economic system means:

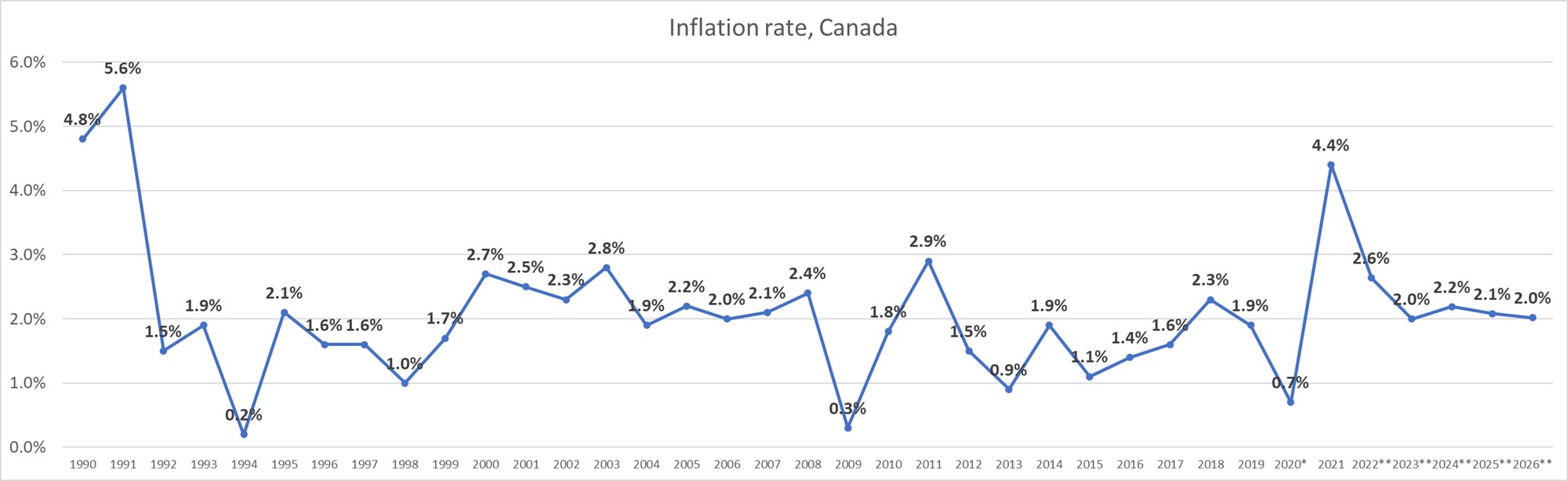

- Inflation of 9% this yr, 6% subsequent yr and three% in 2024.

- Yields on 10-year U.S. authorities bonds averaging 3.25% this yr and three.75% over the next two years.

- Gross home product progress falling to 1.5% this yr, 0.5% subsequent yr and 1.5% in 2024.

The Fitch analysts created charts exhibiting how their baseline unhealthy economic system situation may have an effect on various kinds of efficiency measures at various kinds of insurers.

The North America Particulars

When a life insurer points a life insurance coverage coverage or annuity contract, it takes in premiums in the present day, invests the premiums, after which makes use of a mixture of premium income and earnings on the funding portfolio to pay advantages later.

As a result of, for regulatory causes, the standard life insurer in North America tends to focus closely on investments in high-grade company bonds, with some mortgages, mortgage-backed securities, authorities bonds and different interest-sensitive holdings, rising charges can do rather a lot to extend their funding yields.

For North American insurers of all types, the results of the baseline unhealthy economic system situation are optimistic, the analysts say.

For North American life insurers, the results on reserves and revenue margins could be impartial, and the results and gross sales volumes could be damaging.