LIC unveils New Dhan Varsha Life Insurance coverage Plan: Life Insurance coverage Company of India Restricted (LIC) has launched new Dhan Varsha life insurance coverage plan with impact from October 17. Notably, it is a non-linked, non-participating, particular person, financial savings, and single premium life insurance coverage plan.

The plan brings a mixture of safety and financial savings by offering monetary help for the household in case of the demise of the life assured throughout the coverage time period. The plan additionally supplies a assured lumpsum quantity on the date of maturity for the surviving life assured.

The plan is shut ended and is obtainable on the market as much as March 31, 2023. The proposer can choose the time period both for 10 years or 15 years. The minimal age of entry for the ten & 15 12 months time period is 8 years and three years respectively. The utmost age at entry varies from 35 to 60 years relying on the time period and possibility of sum assured on the occasion of demise.

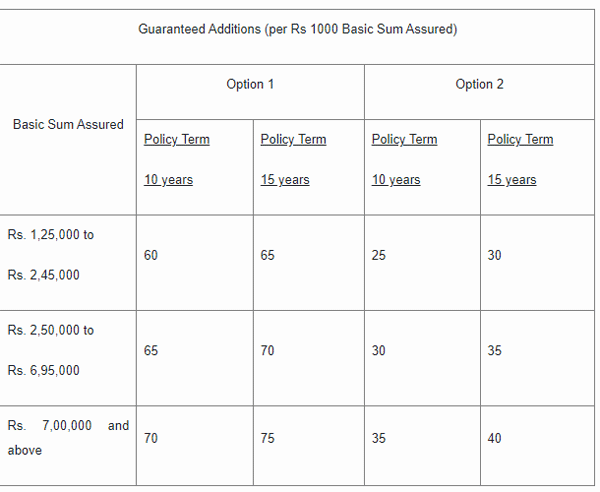

The minimal fundamental sum assured is Rs.1,25,000 and there’s no restrict for optimum fundamental sum assured. The insured can apply for a mortgage if sure circumstances are met. Assured additions shall accrue on the finish of every coverage 12 months, all by way of the coverage time period. The assured additions will rely upon the choice availed, fundamental sum assured and the coverage time period.

Demise profit can be payable, on the demise of the life assured throughout the coverage time period after the date of bengening of danger however earlier than the date of maturity, shall be “Sum Assured on Demise” together with accrued Assured Additions.

IN phrases of Maturity Profit, on Life Assured surviving the stipulated Date of Maturity, “Fundamental Sum Assured” along with accrued Assured Additions shall even be payable.

A Assured Additions shall accrue on the finish of every coverage 12 months, all by way of the coverage time period and shall rely on the Choice chosen, Fundamental Sum Assured and the Coverage Time period.

The minimal age for a 15-year coverage is three years whereas for the Ten-year coverage time period, the minimal age is 8 years.

LIC, Govt to promote 60.7 computer stake in IDBI Financial institution

Rupee Vs Greenback: Congress says FM qualifies for a PhD in Economics

India to turn out to be quickest rising economies however world challenges’