The Life Insurance coverage Company (LIC) of India has launched New Pension Plan (NPP) – a non-participating, unit linked, particular person pension plan – that could be utilized by people to construct corpus by systematic and disciplined financial savings, which might be transformed into common revenue as annuity on retirement and even as early as 35 years of age.

Just like the Nationwide Pension System (NPS), LIC’s New Pension Plus (NPP) additionally gives pension seekers varied funding choices, out of which an investor might choose the one which fits his/her danger urge for food and risk-taking capability.

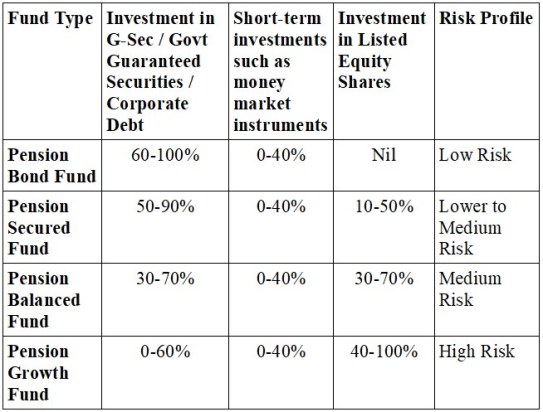

The funding choices obtainable are Pension Bond Fund, Pension Secured Fund, Pension Balanced Fund, Pension Development Fund and Pension Discontinued Fund.

Besides the Pension Disciplined Fund, the funding sample and danger profile are given within the desk beneath:

Pension Discontinued Fund: This fund shall be a segregated Unit Fund and shall comprise of all of the Discontinued Coverage Funds of all of the insurance policies provided beneath the Unit Linked Pension merchandise.

Eligibility Circumstances and Options

The eligibility circumstances of LIC’s New Pension Plus (NPP) are as follows:

Entry Age

The minimal entry age is 25 years and the utmost entry age is 75 years.

Vesting Age

The minimal vesting age or the minimal age at which one might choose to get common annuity is 35 years and the utmost vesting age is 85 years.

Coverage Time period

The minimal coverage time period is 10 years and most is 42 years.

Premium Cost Choices

There are two premium cost choices – single premium and common premium. For normal premium, the premium paying time period would be the similar because the coverage time period.

Minimal and Most Premium

The minimal premium varies with the frequency of cost. For month-to-month cost, the minimal premium is Rs 3,000, for quarterly Rs 9,000, for half yearly Rs 16,000 and for yearly cost, the minimal premium is Rs 30,000. There isn’t a cap on most premium.

Partial Withdrawals

Topic to coverage phrases and circumstances, most three partial withdrawals between 10 per cent to 25 per cent of fund worth primarily based on premium band are allowed in the course of the coverage time period for specified functions like schooling, therapy, marriage, residence and so forth. The costs per withdrawal shall be Rs 100.

Assured Additions

On the in-force insurance policies, assured additions as much as 15.5 per cent of annualised premium on common premium plans and as much as 5 per cent on single premium on single premium plans shall be added on the finish of sixth yr, tenth yr and each subsequent yr from the eleventh yr until the top of the coverage time period.

Insurance coverage Cowl

In case of the unlucky demise of a policyholder in the course of the coverage time period, an quantity greater of the fund worth and 105 per cent of the whole premium paid (excluding taxes, curiosity on late cost and costs, if any) shall be paid to the nominee.

Commutation

On the time of vesting, as much as 60 per cent of the fund worth could also be commuted and the remainder shall be utilised to buy fast or deferred annuity plans. The date of vesting could also be prolonged by a policyholder by intimating the LIC of India earlier than 3 months from the date of authentic vesting.

Buy of Annuity Plan

At the very least 40 per cent of the fund worth should be utilised to buy Annuity Plans from the LIC of India or some other IRDAI-regulated insurance coverage firm, topic to phrases and circumstances.