What You Must Know

- Your purchasers might lose the power to work, or die.

- Some insurance coverage is healthier than none.

- Sufficient protection beats some protection.

For the reason that pandemic, extra corporations have began to supply medical health insurance and group life insurance coverage than ever earlier than.

Nonetheless, greater than 100 million people in the USA don’t have adequate protection to offer their households with monetary safety in case of a tragedy, based on the 2022 Insurance coverage Barometer Examine by LIMRA and Life Occurs.

One of many most important boundaries to monetary safety is the low protection that fundamental group life insurance coverage insurance policies present.

If companies need to assist their workers — your purchasers — obtain monetary safety, they have to transcend the advantages supplied via customary group life protection.

Right here’s what you want to find out about the way in which corporations provide your purchasers life insurance coverage now and the way that would change sooner or later.

Life Insurance coverage Right this moment

When employers began providing group life insurance coverage insurance policies, many staff who wouldn’t in any other case have entry to life insurance coverage all of a sudden had protection, nevertheless restricted.

Group insurance coverage insurance policies are engaging as a result of their approval by an insurer is nearly assured.

Among the most important options of group life insurance coverage embrace that shopper corporations often have to renew group insurance coverage insurance policies yr by yr or each 5 years.

The premiums are low, so group life insurance coverage is inexpensive for many corporations.

Protection is often mounted quite than based mostly on the person’s well being.

Some fundamental insurance policies present minimal protection for a partner and kids, or workers should buy supplemental insurance coverage for higher protection.

Sadly, there are some downsides to group life insurance coverage.

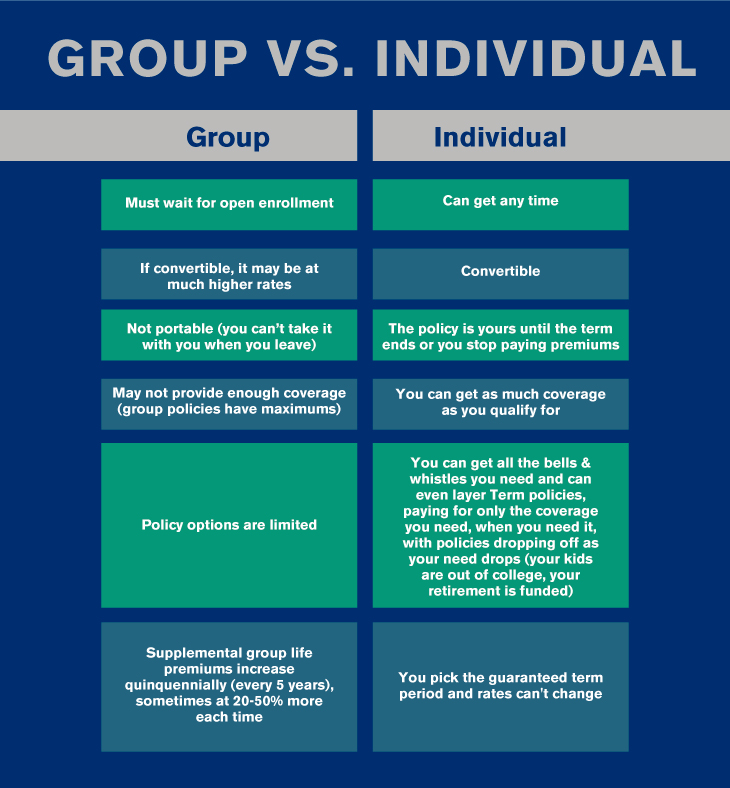

First, group insurance coverage isn’t moveable if an worker modifications jobs, as a result of the enterprise owns the coverage.

Because of this some workers who resign or lose their jobs are in for a impolite awakening when their insurance policies all of a sudden lapse.

Second, group insurance coverage protection could be very restricted.

A median fundamental group life insurance coverage coverage solely quantities to 1 or two instances a person’s annual wage.

That is far cry from the beneficial stage of 5 to 10 instances the person’s annual revenue. Which implies, ought to the worst happen, the worker’s household might be left considerably unprotected past the primary yr or so.

It’s true that workers can even purchase supplemental life insurance coverage via their employers, although such insurance policies can nonetheless have limits.

However for that elevated protection, most employers and insurers require further varieties and proof of insurability, which might take a number of weeks to course of, plus in some instances medical exams.

Right this moment we’re accustomed to buying gadgets on Amazon and having them shipped to our home inside 24 hours, or paying for groceries and having them delivered to our doorstep inside an hour.

So, a weeks-long wait for all times insurance coverage can appear just a little extreme.

Plus, supplemental life insurance coverage often must be renewed on an annual foundation and premiums can change from yr to yr.

The downsides of group life insurance coverage aren’t restricted to these for workers.