It’s normal for a lot of traders, particularly those that are inexperienced, to purchase shares in corporations with a very good story even when these corporations are loss-making. However as Peter Lynch stated in One Up On Wall Avenue, ‘Lengthy pictures nearly by no means repay.’ Loss making corporations can act like a sponge for capital – so traders ought to be cautious that they are not throwing good cash after unhealthy.

So if this concept of excessive threat and excessive reward does not go well with, you may be extra fascinated with worthwhile, rising corporations, like HDFC Life Insurance coverage (NSE:HDFCLIFE). Whereas this does not essentially communicate as to if it is undervalued, the profitability of the enterprise is sufficient to warrant some appreciation – particularly if its rising.

View our newest evaluation for HDFC Life Insurance coverage

How Quick Is HDFC Life Insurance coverage Rising Its Earnings Per Share?

Even modest earnings per share development (EPS) can create significant worth, when it’s sustained reliably from yr to yr. So it is no shock that some traders are extra inclined to put money into worthwhile companies. It is good to see that HDFC Life Insurance coverage’s EPS has grown from ₹5.78 to ₹7.04 over twelve months. There’s little doubt shareholders could be proud of that 22% achieve.

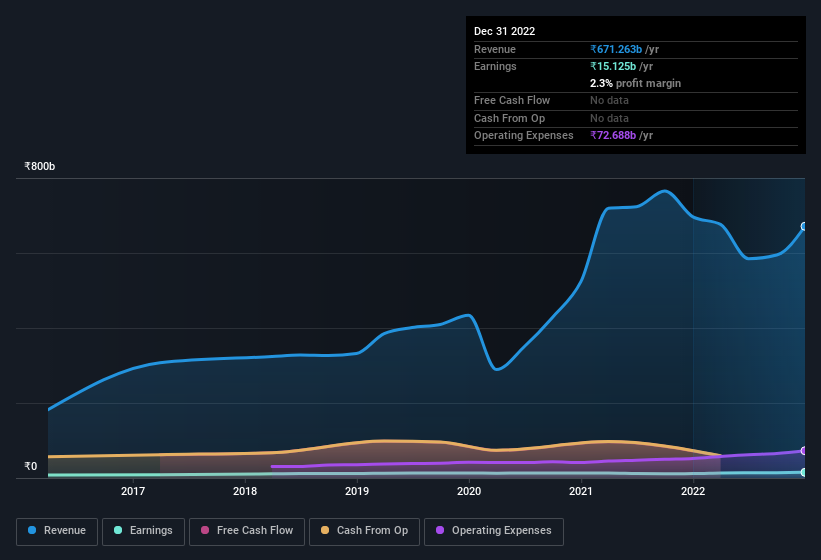

High-line development is a superb indicator that development is sustainable, and mixed with a excessive earnings earlier than curiosity and taxation (EBIT) margin, it is a good way for a corporation to keep up a aggressive benefit out there. Not all of HDFC Life Insurance coverage’s income this yr is income from operations, so consider the income and margin numbers used on this article may not be the very best illustration of the underlying enterprise. Whereas HDFC Life Insurance coverage might have maintained EBIT margins over the past yr, income has fallen. This doesn’t bode too nicely for brief time period development prospects and so understanding the explanations for these outcomes is of nice significance.

The chart beneath reveals how the corporate’s backside and prime traces have progressed over time. For finer element, click on on the picture.

You do not drive along with your eyes on the rear-view mirror, so that you may be extra on this free report displaying analyst forecasts for HDFC Life Insurance coverage’s future income.

Are HDFC Life Insurance coverage Insiders Aligned With All Shareholders?

Owing to the dimensions of HDFC Life Insurance coverage, we would not anticipate insiders to carry a big proportion of the corporate. However because of their funding within the firm, it is pleasing to see that there are nonetheless incentives to align their actions with the shareholders. Given insiders personal a big chunk of shares, presently valued at ₹4.6b, they’ve loads of motivation to push the enterprise to succeed. That is actually sufficient to let shareholders know that administration can be very focussed on long run development.

It means so much to see insiders invested within the enterprise, however shareholders could also be questioning if remuneration insurance policies are of their greatest curiosity. A short evaluation of the CEO compensation suggests they’re. Our evaluation has found that the median whole compensation for the CEOs of corporations like HDFC Life Insurance coverage, with market caps over ₹652b, is about ₹108m.

HDFC Life Insurance coverage’s CEO took residence a complete compensation bundle value ₹74m within the yr main as much as March 2022. That appears fairly affordable, particularly given it is beneath the median for comparable sized corporations. CEO compensation is hardly a very powerful side of an organization to contemplate, however when it is affordable, that provides somewhat extra confidence that management are searching for shareholder pursuits. Usually, arguments could be made that affordable pay ranges attest to good decision-making.

Is HDFC Life Insurance coverage Price Conserving An Eye On?

As beforehand touched on, HDFC Life Insurance coverage is a rising enterprise, which is encouraging. The truth that EPS is rising is a real constructive for HDFC Life Insurance coverage, however the nice image will get higher than that. With a significant stage of insider possession, and affordable CEO pay, an inexpensive thoughts may conclude that that is one inventory value watching. You continue to must be aware of dangers, for instance – HDFC Life Insurance coverage has 1 warning signal we predict you have to be conscious of.

The fantastic thing about investing is that you could put money into nearly any firm you need. However when you favor to deal with shares which have demonstrated insider shopping for, right here is an inventory of corporations with insider shopping for within the final three months.

Please be aware the insider transactions mentioned on this article seek advice from reportable transactions within the related jurisdiction.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not HDFC Life Insurance coverage is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.