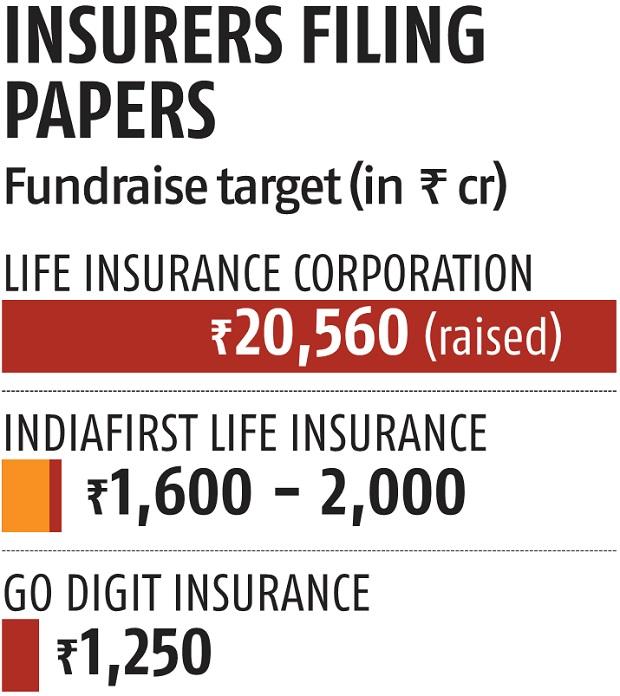

Financial institution of Baroda-promoted IndiaFirst Life Insurance coverage has filed preliminary papers with capital markets regulator Sebi to boost funds by means of an preliminary public providing (IPO). In line with service provider banking sources, the IPO dimension may very well be between Rs 2,000 crore and Rs 2,500 crore. The general public concern consists of a contemporary concern of fairness shares value as much as Rs 500 crore and an offer-for-sale (OFS) of as much as 141,299,422 fairness shares by promoter and promoting shareholders, as per the draft pink herring prospectus (DRHP). As part of the OFS, Financial institution of Baroda (BOB) would promote 89,015,734 shares, Carmel Level Investments India would offload 39,227,273 shares and Union Financial institution of India would divest 13,056,415 shares. BOB, India’s third largest PSU financial institution, holds 65 per cent stake within the firm, adopted by Warburg Pincus affiliate Carmel Level Investments India that owns 26 per cent stake and Union Financial institution of India that has 9 per cent shareholding. Proceeds from the contemporary issuance value Rs 500 crore will probably be used in direction of augmentation of its capital base to assist solvency ranges. Web premiums earned by the the Mumbai-headquartered insurance coverage firm elevated by 27.80 per cent to Rs 4,985.21 crore for the monetary 12 months 2022 from Rs 3,900.94 crore in FY 2021. The agency’s embedded worth elevated at a CAGR of 11 per cent from Rs 1,681.20 crore in FY21 to Rs 1,865.01 crore in FY 22. As of June this 12 months, it had 1,634 particular person brokers and 21 company brokers. ICICI Securities, Ambit, BNP Paribas, BOB Capital Markets Restricted, HSBC Securities and Capital Markets (India) Non-public Restricted, Jefferies India, and JM Monetary are the e-book operating lead managers to the problem. The fairness shares are proposed to be listed on BSE and NSE.

(This story has not been edited by Devdiscourse workers and is auto-generated from a syndicated feed.)